can you work part time and collect social security disability

You can do both. Obviously there are limits that apply because if you are disabled and receiving benefits then you should be unable to work a regular full-time job.

8 Things Everyone Wants To Know About Social Security Becu

Social Security Disability is an insurance program that covers lost wages in the event that an employee sustains work-related injuries.

. You can work part-time and make money and receive Social Security Disability benefits. However there are strict limits as to how much you can work and earn while getting Social Security Disability Insurance SSDI. Fast Easy to Check - See if You Qualify Now.

You can work and collect Social Security Disability benefits in North. You can work part time while on Social Security Disability. Ad See if You Qualify for up to 314800 per month.

You must file the expedited reinstatement within five years of the month your Social Security Disability benefits were terminated and you must be unable to work or perform SGA level work because of the same disabling condition or conditions that caused you to be initially approved for disability benefits. Free Case Review Start Now. But in some cases you may take part in work incentives while receiving the full amount of SSDI.

Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. Easy Form Free Help. You just have to make sure your income doesnt exceed the limitations for substantial gainful activity or SGA.

Earnings between 20 and 80 of your prior income will usually reduce your full LTD amount in proportion to your income. It is possible to receive Social Security disability benefits if you are working part-time. The Journal of Behavioral Health Services and Research.

The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems. So yes you can work while on social security disability. You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year.

The SGA amount is a set maximum monthly wage that helps the Social Security Administration SSA determine whether or not your disability prevents you from earning a living. In most cases you will continue to receive benefits as long as you have a disability. Starting with the month you reach full retirement age we will not reduce your benefits no matter how much you earn.

Grow Your Career Today - View Full Part Time Positions. Learn exactly what each incentive entails and your rights and responsibilities so that you can keep your benefits while trying to get your footing back in the workforce. No new application or disability decision is needed to receive a Social Security disability benefit during this period.

Many policies provide for residual or partial disability payments which allow someone capable of only part-time work to receive ongoing benefits. Working a part-time job can help a disabled person emotionally and financially. For example your health may improve or you might go back to work.

Despite the stringent total disability standards applicable to Social Security Disability Insurance SSDI claimants some beneficiaries can work part-time while receiving SSDI benefits. Based on this you would think that working part-time while collecting SSDI benefits would be a definite no-no But surprisingly thats not the case. However there are certain circumstances that may change your continuing eligibility for disability benefits.

If you are currently receiving Supplemental Security Income SSI or Social Security Disability Insurance SSDI benefits you must comply with strict rules regarding your employment. You can get Social Security retirement benefits and work at the same time. Can You Work Part-Time on Social Security Disability.

However you need to know the rules for doing so. If you are currently receiving Social Security Disability benefits they will end if. The short answer is yes.

The law requires that we review your case from time to time to verify that you still have a disability. Many beneficiaries dont know about the Social Security Administrations SSA work allowances because the majority of SSDI beneficiaries can no longer work in their usual. If you earn more than this amount called the substantial gainful activity SGA limit Social Security assumes you can do a substantial amount of work and you wont be eligible for disability.

In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial. The SSA wants you to work so the amount of benefits they have to pay out is reduced. Whether youre already receiving benefits or are just starting the social security disability application process you may be wondering if working part-time on disability is an.

Ad Free Disability Claim Evaluation. Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits. Find Out if Youre Eligible to Get Disability Benefits - Up to 3345mo.

Yes you can work and still receive Social Security disability benefits SSD under the Social Security Administrations work incentive programs. Are You Taking Part in One of Social Securitys Work Incentives Programs. Many people ask about the possibility of collecting Social Security Disability while working part-time.

Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. The most important thing to remember is that trying to work should not lessen your chances of receiving Social Security disability benefits. Apply for Social Security Disability.

36 months during which you can work and still receive benefits for any month your earnings arent substantial In 2022 we consider earnings over 1350 2260 if youre blind to be substantial. Generally speaking you cannot work while receiving Social Security disability but there are some exceptions. As of 2021 you can earn up to 1310 per month and still receive SSDI.

When you collect Social Security disability benefits the decision whether or not to attempt to work is complicated because you need to consider personal medical vocational and legal issues. Social Security Disability. However if you are younger than full retirement age and make more than the yearly earnings limit we will reduce your benefit.

Will My Ssdi Benefit Increase If My Condition Worsens

Program Explainer Special Minimum Benefit

How Long Term Disability Works With Social Security Disability Cck Law

What Are Social Security Credits

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

Maximize Social Security Spousal Benefits With These Strategies

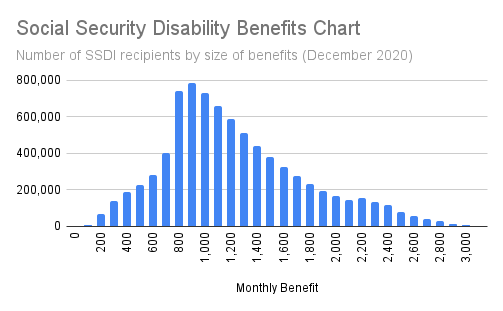

How Much In Social Security Disability Benefits Can You Get Disabilitysecrets

Social Security Ssdi And Ssi Are Different Programs

8 Things Everyone Wants To Know About Social Security Becu

How To Get The Maximum Social Security Benefit Smartasset

Breaking Down Social Security Retirement Benefits By Age Simplywise

2021 Social Security Payment Schedule

Social Security Types Payouts The Program S Future

/what-you-must-know-about-the-social-security-debit-card-47c8b082ff2740a9a836e074fc5a6253.png)

What You Must Know About The Social Security Debit Card

Social Security How Much Can Draw Upon And Earn In 2022 Is There A Limit As Com

How To Get Social Security Benefits If You Ve Never Worked A Day In Your Life The Motley Fool

How Many Hours Can I Work On Ssdi John Foy Associates

Can You Get Both Ssdi And Ssi Disability Benefits

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age